Published, April 17th 2022

“Softbank’s strategy still lacks common business sense. The number one rule in investing: Don’t lose money”

With recent reports showing Softbank has made a loss of $12.5bn, it’s easy to see how, as many of the individual investments themselves have flawed business models. The overarching investment strategy is an interesting one:

- Softbank’s model is to over-invest and over-value

- This creates a leader and a marketplace, a self fulfilling prophecy, catapulting their investment companies to dominate.

- The model itself could be very profitable, however in my opinion some of their investments have not had sufficient risk assessment: WeWork and Uber being amongst the most alarming.

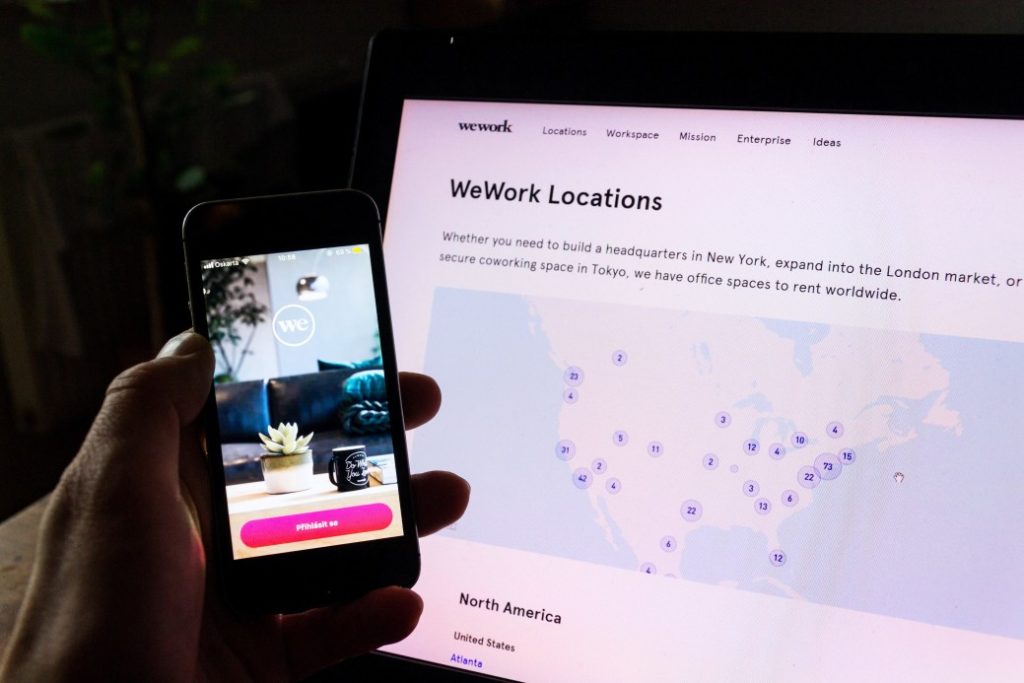

WeWork’s model is to take leases on buildings that other people own, and oversell the underlying desk space, which in theory makes more money than a typical rental return. Therefore, by not owning the underlying building they are in theory not taking the risk. The reality is, however, there are huge fixed costs which in a downturn they can’t cover. Tying themselves up to long term leases adds no balance sheet value.

When it comes to Uber, their model is more complicated and problematic than other sharing economy organisations like Airbnb: With Uber, there are multiple issues. In many cases there are cars to supply, in some cases help to buy cars, as well as political and legal minefields to overcome. Airbnb is also risky in terms of legal challenges, but it’s a case of the owner simply using an asset, without any fixed cost risk. What’s more, Airbnb is a global model but Uber is regional and easier to imitate.

In summary, Softbank’s “Beyond Carrier” strategy is to connect people, things and events through telecommunications. (www.softbank.com) This mission may be at the heart of their chosen investments, and arguably, propelling the growth of companies like Uber has created huge cultural and social changes through technology. Common business sense is still needed though: To me it seems the basics of risk assessment and business modelling have been neglected in some of Softbank’s more infamous investments.