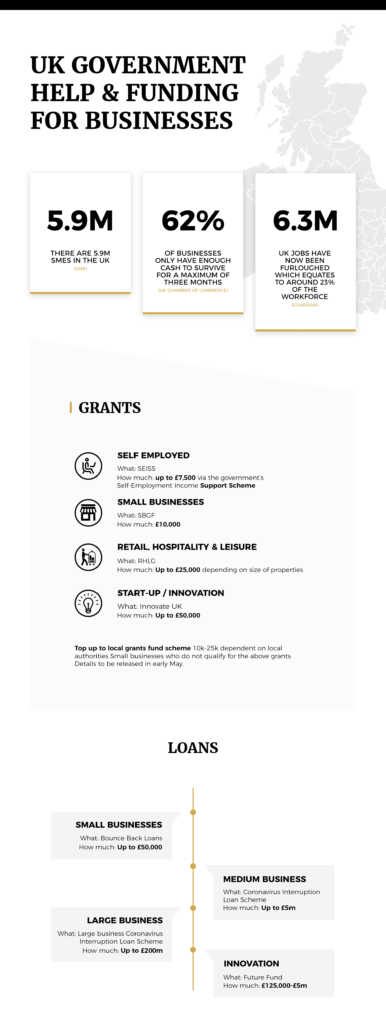

You’re pivoting, you’re cost cutting, but the situation is still bleak; Grants, loans and subsidies could make or break your business right now. If you haven’t already, ensure you’re not missing a trick with a grant to help you get through the coronavirus pandemic. Loans can also be very helpful, as long as you understand the terms and fully analyse your expected performance post-lockdown. With any loan, always ensure the metrics make sense and do your homework before applying.

Grants

The government grants for companies hit by #Covid 19 are detailed here. You may also find local authorities, charities and organisations offer industry specific grants. A good place to look for these is Grantfinder

Self Employed: help for the Self Employed during Coronavirus

If you are self employed and have lost income, a taxable grant will be paid to the self-employed or partnerships, worth 80% of profits up to a cap of £2,500 per month.

Initially, this will be available for three months in one lump-sum payment, and will start to be paid from the beginning of June.

Small Business Grant Fund (SMGF)

Under the Small Business Grant Fund (SBGF) all eligible businesses in England in receipt of either Small Business Rates Relief (SBRR) or Rural Rates Relief (RRR) in the business rates system will be eligible for a payment of £10,000.

Find out more

Retail, Hospitality and Leisure Grand Fund (RHLGF)

| Under the Retail, Hospitality and Leisure Grant (RHLG) eligible businesses in England in receipt of the Expanded Retail Discount (which covers retail, hospitality and leisure) with a rateable value of less than £51,000 will be eligible for a cash grant of £10,000 or £25,000 per property. Eligible businesses in these sectors with a property that has a rateable value of up to and including £15,000 will receive a grant of £10,000. Eligible businesses in these sectors with a property that has a rateable value of over £15,000 and less than £51,000 will receive a grant of £25,000. Businesses with a rateable value of £51,000 or over are not eligible for this scheme. Businesses which are not ratepayers in the business rates system are not included in this scheme. Find out more |

Innovate UK Grant

Grants of up to £50,000 will be available to technology and research-focussed businesses to develop new ways of working and help build resilience in industries such as delivery services, food manufacturing, retail and transport, as well as support people at home in circumstances like those during the coronavirus outbreak.

Future Fund- convertible loan

The Future Fund will provide government loans to UK-based companies ranging from £125,000 to £5 million, subject to at least equal match funding from private investors.

The application process is investor-led. This means an investor, or lead investor of a group of investors, applies in connection with an eligible company. As a company you can still register your interest though the relevant pages on the uk.gov website.

Eligibility

You’re eligible if your business:

- is based in the UK

- can attract the equivalent match funding from third-party private investors and institutions

- has previously raised at least £250,000 in equity investment from third-party investors in the last 5 years

There are also eligibility criteria for investors.

Find out more about Future Fund

Loans

Loans on offer depend on your circumstances and I would always advise you analyse your cash flow fo the next 6-12 months, taking into account the current climate. How many customers can you serve in six months when social distancing measures continue? Do you need to add any element of a personal guarantee? Think carefully and take advice where needed. A loan could help tide you over, but just ensure it works for your evolving business too.

Here is more information on the loans on offer.

Bounce Back Loans

| Small firms will be able to take out interest free loans worth up to £50,000 under a new emergency micro-loans scheme. New “bounce-back” loans will be 100 per cent guaranteed by the Government.The Government will cover the interest on the loans for the first 12 months, with firms able to pay back the remaining balance over the next five years at “very low” interest rates. This scheme will help small and medium-sized businesses affected by coronavirus (COVID-19) to apply for loans of up to £50,000. Find out more |

Coronavirus Business Interruption Loan Scheme

The Coronavirus Business Interruption Loan Scheme (CBILS) supports small and medium-sized businesses, with an annual turnover of up to £45 million, to access loans, overdrafts, invoice finance and asset finance of up to £5 million for a period of up to 6 years.

The Government will also make a Business Interruption Payment to cover the first 12 months of interest payments and any lender-levied fees. This means smaller businesses will benefit from no upfront costs and lower initial repayments.

The government will provide lenders with a guarantee of 80% on each loan (subject to pre-lender cap on claims) to give lenders further confidence in continuing to provide finance to small and medium-sized businesses.

The scheme is delivered through commercial lenders, backed by the government-owned British Business Bank.

Large Business Interruption Loan Scheme

A government-backed loan scheme for large businesses affected by coronavirus for firms with a turnover of more than £45 million. As of 26th May, 2020, companies who qualify will now be able to apply for up to £200 million of finance, with certain restrictions. To apply, companies must choose a lender who is accredited by the scheme.

Furlough Scheme- New Bonuses for Staff Brought Back from Furlough announced

The Chancellor Rishi Sunak has revealed new “jobs retention bonus” of £1000 per retained employee in next stage of the coronavirus economic plan.

Confused about government support?

There is now a helpful support finder on the UK Gov website, follow this link to access.